You’re on the horn with your insurance agent after buying a beautiful new car. You bought your liability coverage, and now, if you’re lucky, your agent asks whether you want full tort or limited tort[1]. “What’s torque,” you may ask (as so many do). Not torque, your agent chuckles. TORT.

I’m a Philadelphia car accident lawyer. I handle a lot of car accident cases. A lot. And I ask every potential client if they’ve ever heard the terms full tort and limited tort. The answer I hear most often? “Don’t worry, Tom. I have great insurance. Full coverage!”

“Full coverage” is NOT full tort. “Full coverage” simply means you have the required liability and medical benefit coverages, and the optional property damage coverage (see Chapter). Full tort and limited tort, on the other hand, determine your right to get paid for your pain and suffering if you get hurt in an accident. With full tort, you keep an unrestricted right regardless of how serious your injuries are. With limited tort, that right is seriously limited – hence, limited tort. Here’s the legal mumbo jumbo taken directly from the statute[2].

FULL TORT OPTION

The laws of the Commonwealth of Pennsylvania give you the right to choose a form of insurance under which you maintain an unrestricted right for you and the members of your household to seek financial compensation for injuries caused by other drivers. Under this form of insurance, you and other household members covered under this policy may seek recovery for all medical and other out-of-pocket expenses and may also seek financial compensation for pain and suffering and other nonmonetary damages as a result of injuries caused by other drivers.

LIMITED TORT OPTION

The laws of the Commonwealth of Pennsylvania give you the right to choose a form of insurance that limits your right and the right of members of your household to seek financial compensation for injuries caused by other drivers. Under this form of insurance, you and other household members covered under this policy may seek recovery for all medical and other out-of-pocket expenses, but not for pain and suffering or other nonmonetary damages unless the injuries suffered fall within the definition of serious injury. . . .

Notice the “Full Tort Option” specifically says you have the unrestricted right to get paid for your pain and suffering while the “Limited Tort Option” says you have a limited right – you must suffer a serious injury. What’s a serious injury? Great question. In Pennsylvania, it’s an injury resulting in death, serious disfigurement, or a serious impairment of a body function[3]. I’ll get into much more detail about this in another post. For now, though, I just want you to think back to when you bought your insurance. Did your agent explain these two tort options to you? Did your agent explain that you seriously limit your right to get paid for your pain and suffering if you choose limited tort coverage? Did your agent recommend you choose full tort over limited tort? Or did your agent just shove a stack of papers in front of you and say “sign here”?

So limited tort seriously limits your right to get paid for your pain and suffering if you get hurt in an accident. But what, exactly, is pain and suffering? It’s probably a whole lot more than you think. Pain and suffering is, of course, the physical pain and suffering you experience, but it’s also the mental anguish, anxiety, shock, fright, depression, discomfort, inconvenience, distress, embarrassment, humiliation, loss of wellbeing, inability to work, inability to perform household chores, inability to care for your family, etc. It’s also the inability to enjoy life as you did before the accident, before your injuries, which “is as much a loss as an amputation of a body part. The inability to enjoy what one had once enjoyed and appreciated is a loss which can hurt as much as any physical injury . . . .”[4]

Can’t sit, stand, walk, ride in a car, sleep, exercise, paint, play the piano, ride a bike, drive, cook, clean, bathe, etc.? Or simply can’t do these things (and more) without pain? That’s all encompassed in pain and suffering, and your right to get paid for your inability to do these things (and so much more) is seriously limited by limited tort[5].

Now that you know the difference between full tort and limited tort, doesn’t it seem pretty simple? Keep your unrestricted rights with full tort, or seriously limit your rights with limited tort. So why would anyone choose limited tort over full tort? Price, for starters. Because you keep your unrestricted rights with full tort, insurance companies charge you a higher premium for it. Not much higher (usually about 20%), but higher nonetheless. Other reasons? Lack of knowledge or understanding, or (the unconscionable, unforgivable) recommendation from the insurance company.

INSURANCE COMPANIES DON’T WANT YOU TO BE FULLY PROTECTED

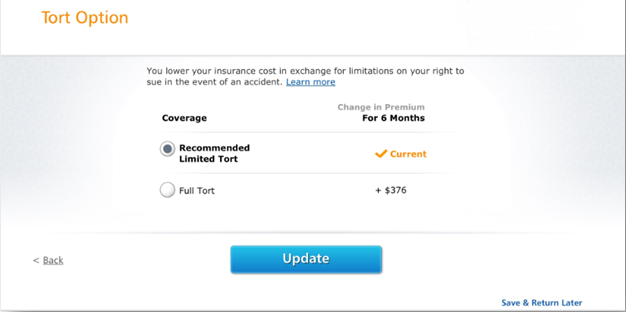

In preparation for writing this likely Pulitzer Prize winning post, I decided to get a quote from a Progressive Insurance. It’s a company with a massive marketing campaign. A company for which I see and hear dozens of advertisements every day in print ads and on TV and radio. I can totally trust Flo, right? She seems so sweet and honest in the commercials. I requested the same top-of-the-line coverage I currently have, for which Progressive wanted to charge me an astronomically high premium (nearly twice as high as my current insurance company), and it recommends I chose limited tort, which it admits “limits my rights to sue in the event of an accident.”

Can you believe that? Progressive recommends I choose limited tort! It recommends I seriously limit my rights in exchange for saving a couple bucks! Hardly seems like it has my best interests in mind. Shouldn’t your insurance company encourage you to fully protect yourself? Shouldn’t it want you to be fully protected? Nope. The company may lose a few bucks by charging a smaller premium for your limited tort policy, but, in the event you’re injured in an accident caused by another one of its insureds (or in the event you make an uninsured or underinsured motorist claim), the company could save tens of thousands of dollars because you’ve seriously limited your rights by choosing limited tort coverage. Remember – the insurance industry is a business, not a charity.

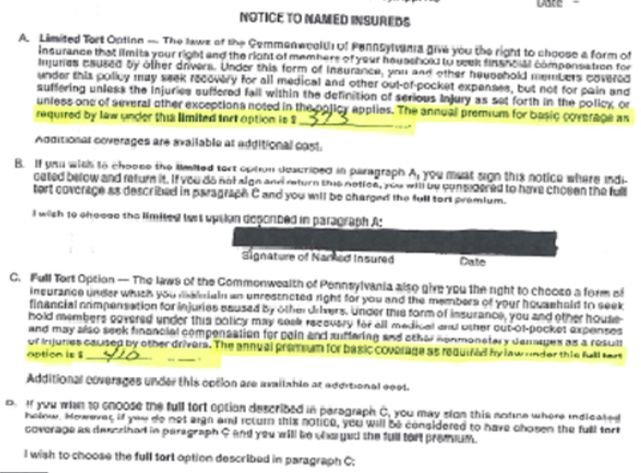

Don’t get caught up in the higher premium for the full tort coverage in my above example, either. As I said, the difference between limited tort and full tort is usually about 20% of the total premium. For the insurance coverage I requested, that 20% difference was $376 every 6 months. Had I requested less insurance coverage, that 20% difference would have been much less. Don’t believe me? Here’s the Tort Election Form for one of my clients, who had insurance with Allstate.

Notice the annual premium for the limited tort option? It’s $373 per year. And the annual premium for the full tort option? $410 per year. That’s a difference of only $37 per year. Per year! That’s a difference of only $3.08 per month, or $0.10 per day! Why would my client seriously limit his rights to save just $37 per year? Because his Allstate agent recommended he choose limited tort, but didn’t tell him what limited tort is, and didn’t tell him he was seriously limiting his rights. Absolutely shameful, and all too common.

So, limited tort seriously limits your right to get paid for your pain and suffering if you get hurt in an accident. But what about your medical bills (past and future), lost wages (past and future), property damage, rental reimbursement, etc.? Good news is that limited tort doesn’t affect your right to get reimbursed for those things. It only affects your right to get paid for your pain and suffering.

Don’t sell yourself short. You are priceless. Your family is priceless. Don’t put a price on your pain and suffering by giving up your right to get paid for it to save a couple bucks. CHOOSE FULL TORT! And if you already have car insurance, check your policy right away. If you have limited tort coverage, call your insurance company and switch to full tort.

I know it can be really confusing and totally overwhelming, so don’t hesitate to reach out to me if you have any questions. I’m a Philadelphia car accident lawyer with an intimate knowledge of car insurance, and I’m always happy to help. You may not need a personal injury lawyer, but I’m here if you want one.

Philadelphia, PA 19103

Facsimile: (215) 525-1199

Masters Degree in Trial Advocacy (with Honors)

America’s Top 100 Attorneys: Top 100

Rue Ratings: The Best Attorneys of America

The National Trial Lawyers: Top 40 Under 40

The National Trial Lawyers: Top 100 Trial Lawyers

American Academy of Trial Attorneys: Premier 100

American Jurist Institute: Top 10 in Pennsylvania

Distinguished Justice Advocates: Top 1% in America

National League of Renowned Attorneys: Top 1% in Pennsylvania

Million Dollar Advocates Forum: The Top Trial Lawyers In America

National Academy of Personal Injury Attorneys: Top 10 in Pennsylvania

American Institute of Personal Injury Attorneys: Top 10 in Pennsylvania

Pennsylvania Super Lawyers: Super Lawyer (Top 5% of All Pennsylvania Attorneys)

Pennsylvania Super Lawyers: Rising Star (Top 2.5% of Pennsylvania Attorneys Younger Than 40)

[1] Agents are required to ask, but many agents simply sell you the cheapest coverage available, which includes limit tort, without actually explaining what you’re buying . . . and what rights you’re seriously limiting.

[2] The full statute, which I’m sure you’re super excited to read in its entirety, is 75 Pa.C.S. 1705.

[3] The seminal case, Washington v. Baxter, is an exhilarating read. Just kidding. It’s terribly boring, but it’s a must read – and a must know – for lawyers handling limited tort cases.

[4] Corcoran v. McNeal, 400 Pa. 14, 161 A.2d 367 (1960); Reist v. Manwiller, 231 Pa.Super. 444, 332 A.2d 518 (1974).

[5] I’ll get into a lot more detail on this, and go over the criteria the Court considers in determining whether someone should be paid for their pain and suffering, in another post.